Planning your vacations, filing for leave, or setting your business calendar? The official list of Philippine holidays for 2026 has been released under Proclamation No. 1006.

This guide covers the complete schedule of Regular and Special Non-Working holidays, along with a comprehensive guide on how to compute holiday pay for employees required to report for duty.

2026 Holiday Summary

- Total Regular Holidays: 10

- Total Special (Non-Working) Holidays: 8

- Long Weekends: 8 (Confirmed based on Friday/Monday dates)

Regular Holidays

Includes New Year, Holy Week, and Christmas. See the Pay Rules section below for “Double Pay” computation.

| Date | Day | Holiday |

| January 1 | Thursday | New Year’s Day |

| April 2 | Thursday | Maundy Thursday |

| April 3 | Friday | Good Friday |

| April 9 | Thursday | Araw ng Kagitingan |

| May 1 | Friday | Labor Day |

| June 12 | Friday | Independence Day |

| August 31 | Monday | National Heroes Day |

| November 30 | Monday | Bonifacio Day |

| December 25 | Friday | Christmas Day |

| December 30 | Wednesday | Rizal Day |

Special (Non-Working) Holidays

Includes Chinese New Year, All Saints’ Day, and Christmas Eve. “No work, no pay” applies unless company policy states otherwise.

| Date | Day | Holiday |

| February 17 | Tuesday | Chinese New Year |

| April 4 | Saturday | Black Saturday |

| August 21 | Friday | Ninoy Aquino Day |

| November 1 | Sunday | All Saints’ Day |

| November 2 | Monday | All Souls’ Day |

| December 8 | Tuesday | Feast of the Immaculate Conception |

| December 24 | Thursday | Christmas Eve |

| December 31 | Thursday | Last Day of the Year |

Holiday Pay Guide: How to Compute Your Wages

Reporting for work on a holiday? Here is the official guide on computing your wages based on the Omnibus Rules to Implement the Labor Code of the Philippines.

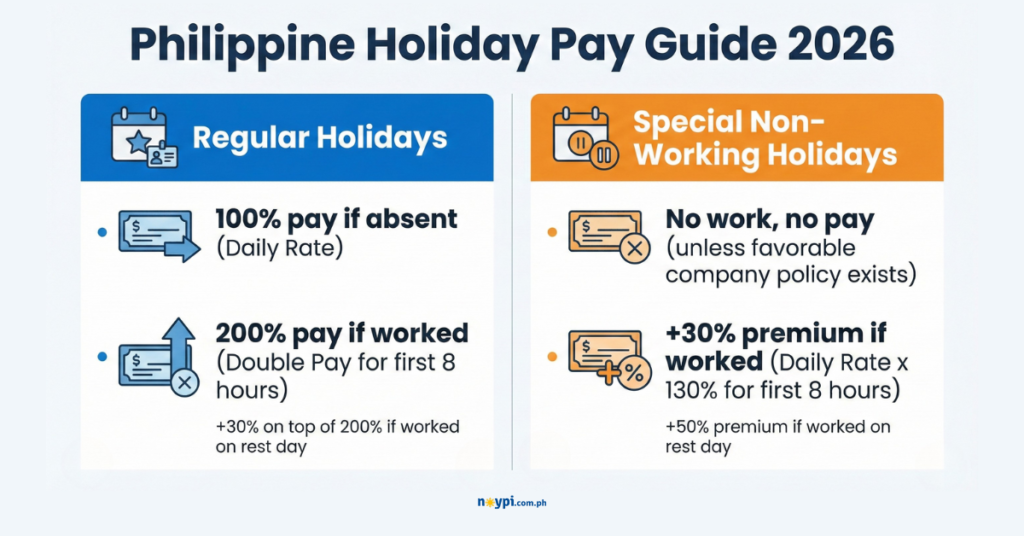

1. For Regular Holidays (Double Pay)

If you work on a regular holiday, you are entitled to at least 200% of your daily wage.

- First 8 Hours:

(Daily Rate + COLA) × 200% - Overtime (In excess of 8 hours):

Hourly Rate × 200% × 130% × Number of Hours Worked - Work on a Rest Day: If the regular holiday falls on your scheduled rest day and you work, you get an additional 30% premium on top of the 200%.

[(Daily Rate + COLA) × 200%] + [30% of (Daily Rate × 200%)]

2. For Special (Non-Working) Days

If you work on a special non-working day, “No Work, No Pay” applies unless there is a favorable company policy. If you do work, you get an additional 30% premium.

- First 8 Hours:

(Daily Rate × 130%) + COLA - Overtime (In excess of 8 hours):

Hourly Rate × 130% × 130% × Number of Hours Worked - Work on a Rest Day: If the special holiday falls on your scheduled rest day and you work, you get an additional 50% premium.

(Daily Rate × 150%) + COLA

2026 Long Weekend Cheat Sheet

Maximize your leave credits by noting these strategic long weekends:

- Holy Week: April 2 (Thu) – April 5 (Sun)

- Labor Day Weekend: May 1 (Fri) – May 3 (Sun)

- Independence Day Weekend: June 12 (Fri) – June 14 (Sun)

- Ninoy Aquino Weekend: August 21 (Fri) – August 23 (Sun)

- National Heroes Weekend: August 29 (Sat) – August 31 (Mon)

- Undas Weekend: October 31 (Sat) – November 2 (Mon)

- Bonifacio Day Weekend: November 28 (Sat) – November 30 (Mon)

- Christmas Weekend: December 25 (Fri) – December 27 (Sun)